AI for Financial Institutions

AI-Driven Fraud Detection for Finance

See how AI protects financial institutions by detecting fraud in milliseconds, analyzing transaction patterns, and preventing losses before they occur. Experience advanced fraud detection AI that monitors transactions in real-time, identifies suspicious patterns, and provides actionable insights for financial risk management.

Demo Fraud Detection AILive Fraud Detection Demonstration

Dive into an interactive simulation where you can observe real-time transaction streams being analyzed by our AI. Watch as the system instantly flags suspicious activities, complete with fraud scoring and clear explanations for each alert. Adjust parameters to see the AI adapt and protect against evolving threats.

- Real-time transaction monitoring with sub-second fraud detection.

- Intuitive alert system demonstrating immediate flagging of high-risk transactions.

- Comprehensive dashboard showing fraud detection statistics and prevention metrics.

AI Transaction Pattern Recognition

Our AI goes beyond simple rules, learning and adapting to subtle shifts in behavioral patterns. Identify unusual spending, detect account takeovers through login anomaly analysis, and flag card-not-present fraud. LumenLink's AI uncovers complex money laundering schemes and prevents merchant fraud before it impacts your bottom line.

- Behavioral analytics identifying unusual spending patterns and locations.

- Account takeover detection through login and transaction behavior analysis.

- Money laundering detection through complex transaction relationship analysis.

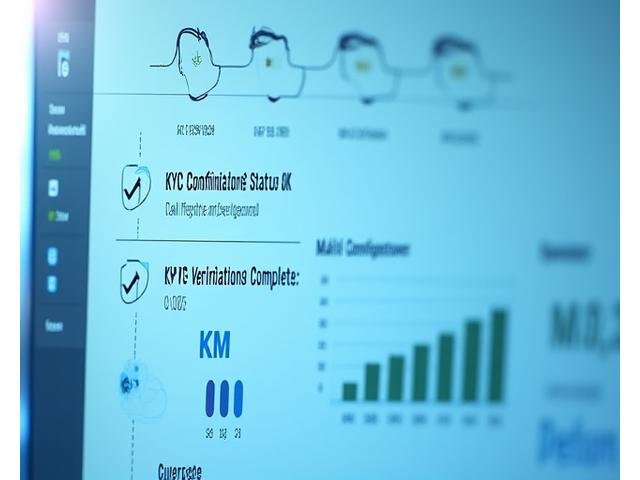

Dynamic Risk Assessment and Scoring

Our dynamic risk scoring engine provides a comprehensive view of potential financial risks. By incorporating transaction, behavioral, and external data, you gain multi-factor risk assessments tailored to your institution's needs. Monitor credit risk with alternative data sources and ensure KYC compliance with automated customer risk profiling, adjusting thresholds in real-time based on market conditions.

- Multi-factor risk scoring incorporating diverse data sources.

- Real-time risk threshold adjustment based on market conditions and trends.

- Portfolio risk analysis for lending and investment decision support.

AI for Financial Compliance and Reporting

Navigate the complex landscape of financial regulations with confidence. LumenLink's AI assists with Anti-Money Laundering (AML) monitoring, automates suspicious activity reporting, and streamlines Know Your Customer (KYC) processes with efficient identity verification. Generate audit trails and gain compliance documentation for AI-driven decisions, ensuring adherence to FFIEC, OCC, and other financial regulatory standards.

- Anti-Money Laundering (AML) compliance monitoring and suspicious activity reporting.

- Know Your Customer (KYC) automation with identity verification and risk assessment.

- Regulatory reporting automation for increased efficiency.

Seamless Integration with Financial Systems

LumenLink's fraud detection AI is engineered for seamless compatibility with your existing financial ecosystem. We offer out-of-the-box integration with major core banking systems like Jack Henry, FIS, and Fiserv, alongside direct connections to payment processors such as Visa and Mastercard. Our API-first architecture ensures flexibility for custom integrations, providing both cloud and on-premise deployment options with robust security and compliance standards.

- Core banking system integration, including Jack Henry, FIS, Fiserv.

- API-first architecture for flexible custom integrations.

- Cloud and on-premise deployment options for diverse operational needs.

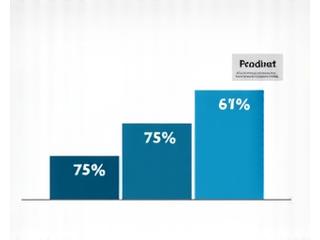

Proven Results from Financial Institutions

LumenLink's AI solutions are delivering tangible results for financial leaders across the industry. See how our fraud detection and compliance tools translate into significant cost savings and enhanced security.

Texas Community Bank

"Our partnership with LumenLink resulted in a remarkable 75% reduction in fraud losses within the first six months. Their AI system flagged sophisticated fraud attempts that our previous rule-based systems missed entirely. This has significantly boosted our customer trust and protected our assets."

— CFO, Mid-sized Community Bank, Texas

Credit Union Network

"LumenLink improved our fraud detection accuracy from 60% to an astounding 99.5% across our entire credit union network. The AI's ability to learn and adapt drastically cut down false positives, allowing our fraud team to focus on real threats and save countless hours."

— Head of Risk Management, Major Credit Union Network

Austin FinTech Startup

"As a rapidly growing fintech, preventing chargebacks is critical. LumenLink's real-time fraud prevention reduced our chargebacks by over 80%. This has been instrumental in safeguarding our reputation and financial stability in a competitive market."

— CEO, Austin-Based Financial Technology Startup

Regional Bank

"Automating our AML compliance with LumenLink's AI has saved our team an estimated 500 hours monthly. The system's precision in identifying suspicious activities and generating accurate reports has drastically improved our operational efficiency and reduced audit risks."

— VP of Operations, Regional Banking Group

Ready to Demo Fraud Detection AI?

Experience the power of proactive financial security. Contact us today to schedule your personalized demonstration.

Schedule a Demo